Workflow 1:

Invoice > Payment (in Odoo) > Bring bank statement > Reconcile

Payment and the bank statement

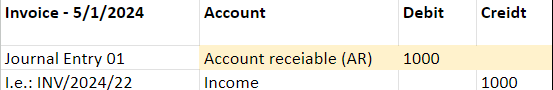

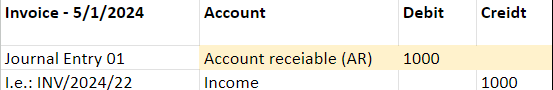

1. Create an invoice for a customer.

This action generates a journal entry (journal entry 01).

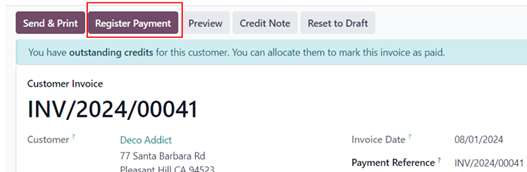

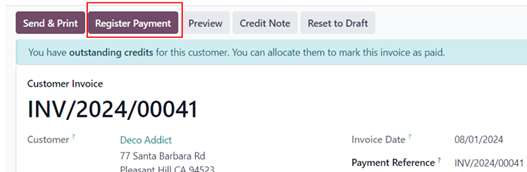

2. The initial reconciliation

occurred when we recorded the payment on the invoice. In this manner, the ‘Register

Payment’ button results in reconciliation with the invoice - Account Receivable

account.

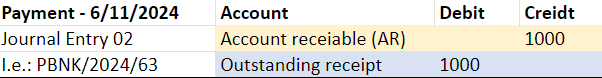

3.

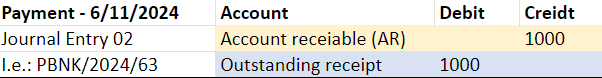

Register payment creates another journal entry (journal

entry 02).

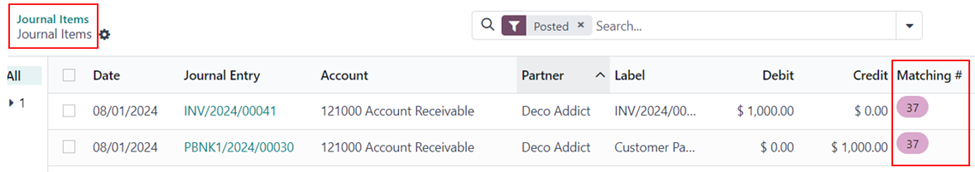

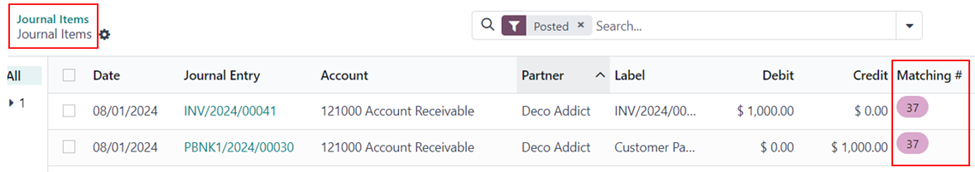

We can find the proof in the journal item,

matching #.

Notes:

If we generate an invoice for customer A for $111 and also create

a customer payment for customer A in the same amount of $111, the journal entry

will display two lines for accounts receivable, one in debit and the other in

credit.

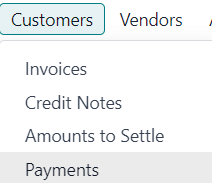

This means the customer payment is not coming from the 'register payment' but customer payment.

It is important to note that these two lines are not 'reconciled'

and therefore do not have a matching number associated with them.

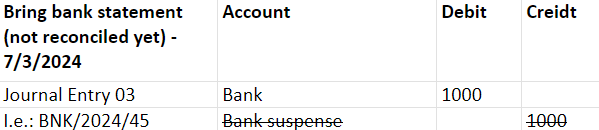

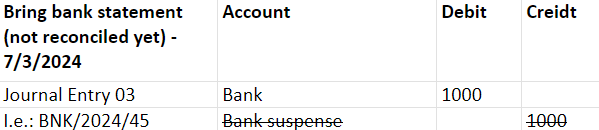

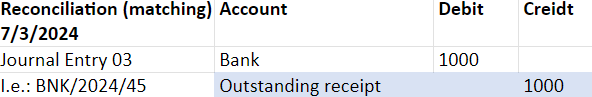

4. When we bring the bank statement to Odoo, this means

there is another journal entry (journal entry 03). On the other hand, the bank

statement line is not reconciled.

The following journal entry hits the bank suspense account. This means the bank statement line is unreconciled.

Also, whether the bank statement has been reconciled or not, the journal entry hits the bank account.

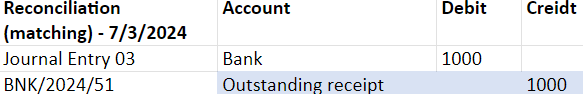

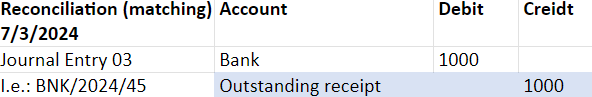

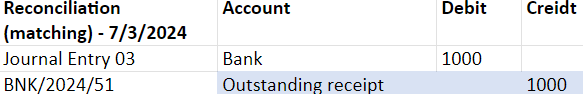

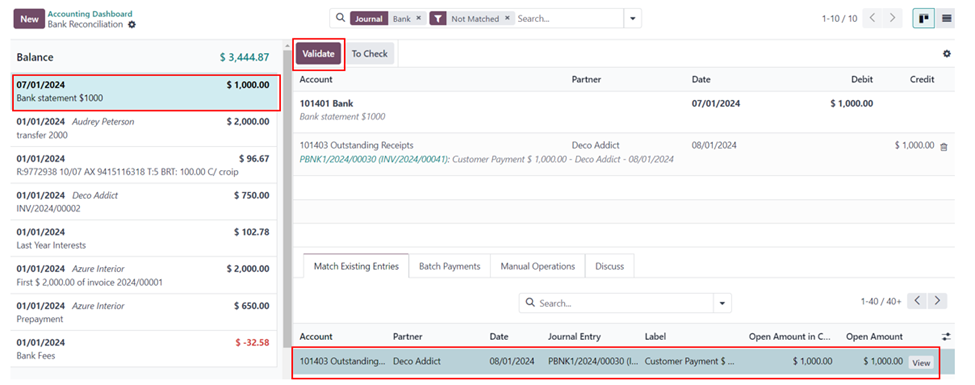

5. Before the bank reconciliation process, journal entry 03 credits the bank suspense account with $1000.

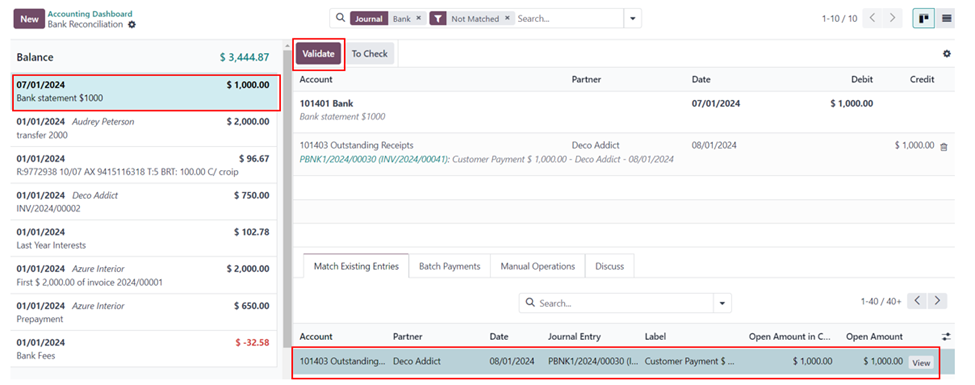

The bank reconciliation process involves selecting the bank statement line from the left table and matching it with the corresponding invoice or payment from the right bottom table.

To finalize the bank reconciliation, simply click on the 'validate' button.

After the bank reconciliation process, the bank suspense account is substituted for the outstanding receipt account credited $1000.

Workflow 2:

Vendor bill > Payment (in Odoo) > Bring bank statement > Reconcile

Payment and the bank statement

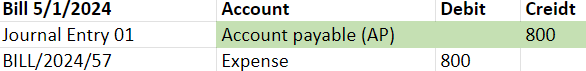

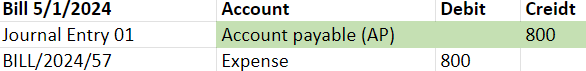

1. Create the vendor bill with the accounting date on 5/1/2024.

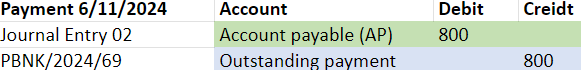

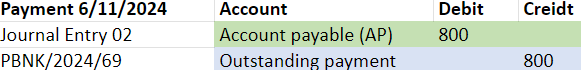

2. Register the payment on 6/11/2024 from the vendor bill. The vendor payment entry and journal item are shown below.

Since Odoo is using the temporary account called Outstanding payment (current asset type account), the bank has not reflected the negative $800 yet.

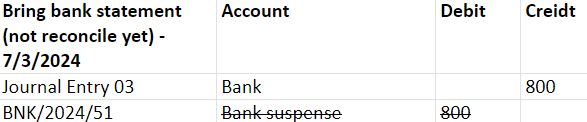

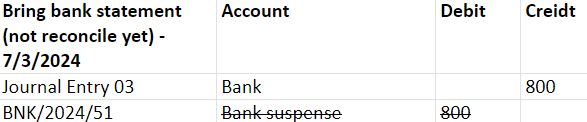

3. Import or synchronize the bank with the bank statement with the date 7/3/2024.

At this point, we have not reconciled the bank statement with the payment PBNK/2024/69 yet.

But on the general ledger, we can see the bank credit 800 reflected on 7/3/2024.

To see how much money has not yet been reconciled from the bank statement, we can see the balance from the bank suspense account.

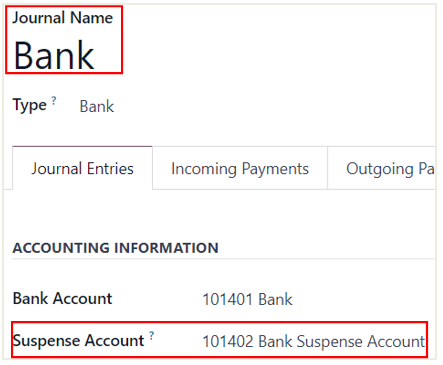

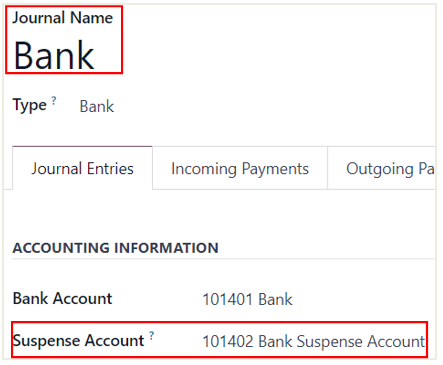

Notes: The bank suspense account can be configured in the journal setting.

4. When we reconcile the bank statement with the payment, the bank statement journal entry will be updated as below.