Prerequisite:

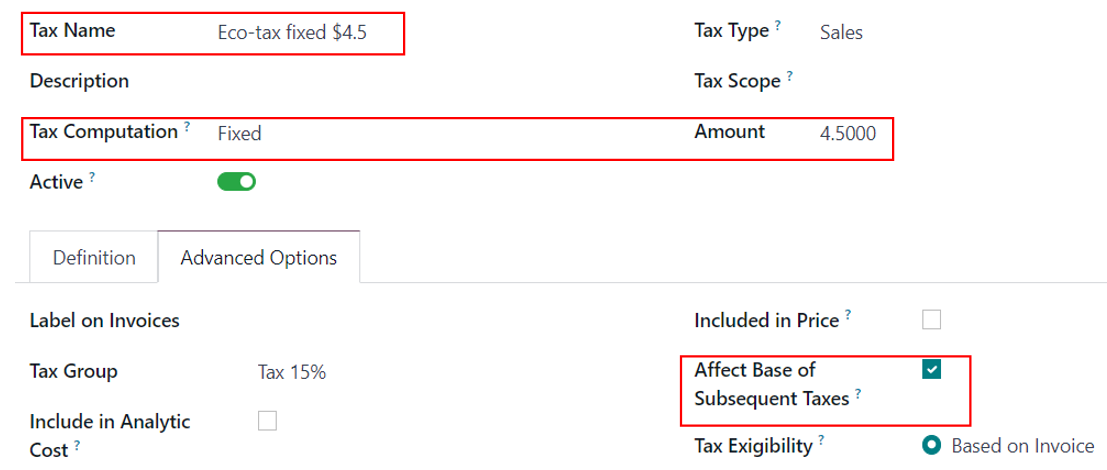

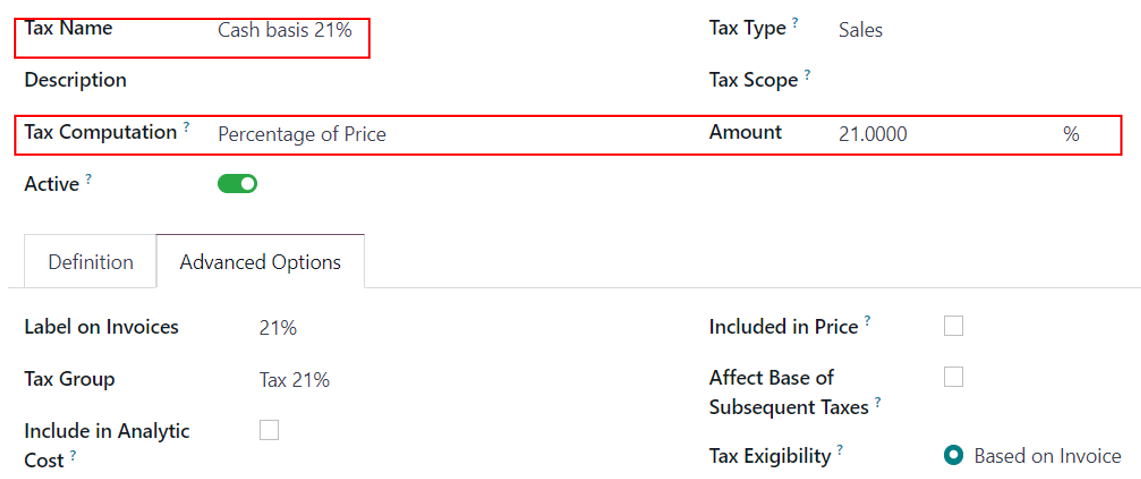

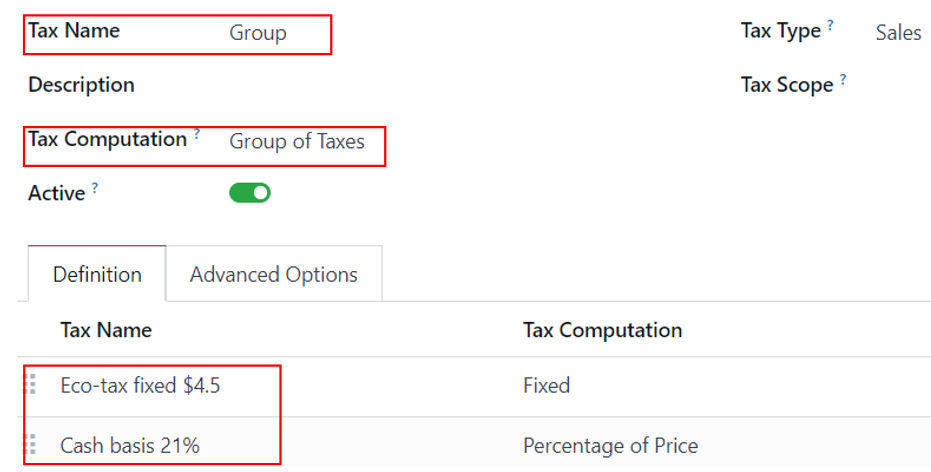

This article contains detailed information on tax setup and cash basis tax functionalities. The screenshot attached is specific to version 17 and the USA localization; however, the process should apply to most versions.

Purpose:

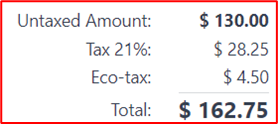

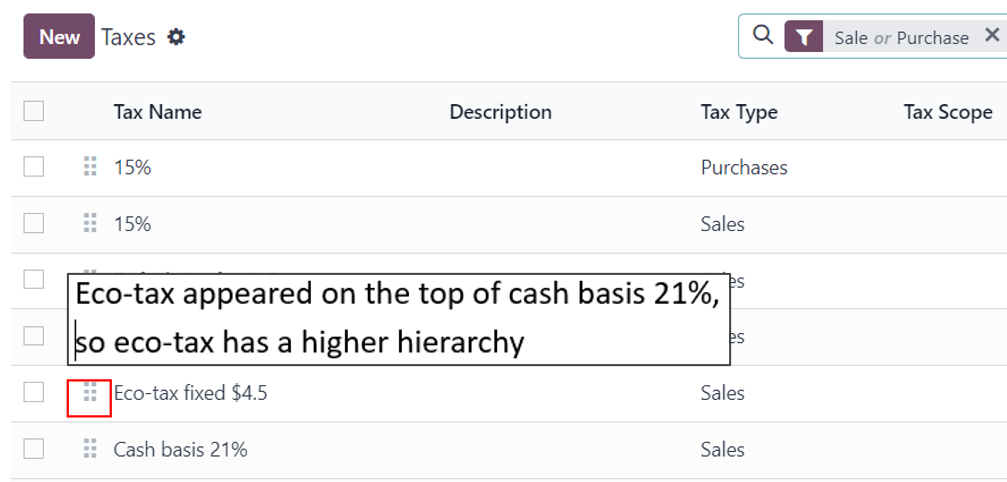

Odoo provides a solution for calculating taxes with a hierarchy in cases involving a combination of fixed and percentage-based taxes. Workflow and outcome: