ใบลดหนี้และการคืนเงิน¶

A credit/debit note, or credit/debit memo, is a document sent to a customer to inform them that they have been credited/debited a certain amount.

กรณีการใช้งานหลายกรณีอาจนำไปสู่ใบลดหนี้ เช่น:

ข้อผิดพลาดในใบแจ้งหนี้

การคืนสินค้าหรือการปฏิเสธการให้บริการ

สินค้าที่จัดส่งได้รับความเสียหาย

ใบเพิ่มหนี้พบได้ไม่บ่อยนัก แต่มักใช้เพื่อติดตามหนี้ที่ลูกค้าหรือผู้ขายเป็นหนี้ เนื่องจากมีการปรับเปลี่ยนใบแจ้งหนี้ของลูกค้าหรือใบเรียกเก็บเงินของผู้ขายที่ยืนยันแล้ว

Note

Issuing a credit/debit note is the only legal method for canceling, refunding, or modifying a validated invoice. Make sure to register the payment afterward if money is being refunded to the customer and/or validate the return if a storable product is being returned.

Issue a customer credit note¶

In most cases, credit notes are created directly from the corresponding invoices. To do so, go to , open the relevant Invoice, and click Credit Note.

In the Credit Note window, fill in the Reason displayed on Credit Note and update the Journal and Reversal date if needed. There are two options:

Click Reverse to open a draft credit note prefilled with the exact details from the original invoice. Update the Product and Quantity and click Confirm. This option allows for a partial refund or modifications to the credit note.

Click Reverse and Create invoice to create a credit note, validate it automatically, reconcile it with the related invoice, and open a new draft invoice prefilled with the exact details from the original invoice.

To create a credit note from scratch, go to , and click New. Filling out a credit note follows the same process as completing an invoice.

Note

A credit note sequence starts with R and is followed by the related document number (e.g.,

RINV/2025/0004 is associated with the invoice INV/2025/0004).

Issue a customer debit note¶

To create a debit note, go to and follow these steps:

Select the desired invoice(s), click Actions and select Create Debit Note.

In the Create Debit Note window, fill in the Reason and update the Use Specific Journal and Debit Note Date fields if needed.

Enable the Copy Lines option to copy the invoice lines and click Create Debit Note.

In the debit note, update the Product and Quantity and click Confirm.

Tip

To create a debit note from the invoice form view, click the (gear) icon and select Debit Note.

บันทึกการคืนเงินของผู้ขาย¶

Vendor refunds or vendor credit notes are recorded the same way as credit notes:

To record a vendor refund or a vendor credit note directly from the corresponding vendor bill, go to , open the relevant vendor bill, and click Credit Note.

To record it from scratch, go to , and click on New.

Record a vendor debit note¶

Debit notes from vendors are recorded the same way debit notes are issued to customers.

To record a debit note, go to and select the desired bill(s). Click Actions and select Create Debit Note.

Tip

To create a debit note from the vendor bill form view, click the (gear) icon and select Debit Note.

รายการสมุดรายวัน¶

Creating a credit/debit note from an invoice/bill generates a reverse entry that cancels out the journal items from the original invoice.

Example

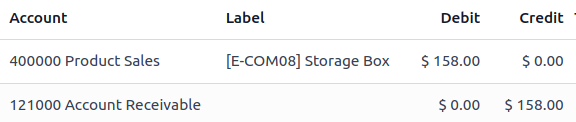

The journal entry of an invoice:

The credit note's journal entry generated to reverse the original invoice above: