Workflow:

- Create and confirm a purchase order - Vendor A:

Product A, quantity 1, unit price $100

Product B, quantity 1, unit price $200

- When we pay the vendor $100 as down payment before we receive the vendor bill, we should create a vendor payment (from accounting application) for Vendor A

Vendor A down payment $100 | Debit | Credit |

Account payable | 100 |

|

Outstanding payment/ Bank |

| 100 |

3. Received products with journal entries.

Journal entry 1 - Product A | Debit | Credit |

Stock valuation | 100 |

|

Stock interim received

|

| 100

|

Journal entry 2 - Product B | Debit | Credit |

Stock valuation | 200 |

|

Stock interim received

|

| 200

|

4. Create a real vendor bill

Vendor bill with full amount | Debit | Credit |

Stock interim received

| 300

|

|

Account payable |

| 300 |

5. Before reconcile the $100 down payment on the full amount bill, Odoo shows the ‘add’ below the total amount.

6. Click on ‘Add’ to reconcile the $100 down payment with the actual vendor bill $300.

We should see the balance of $200 on the account payable.

Vendor A downpayment $100 | Debit | Credit |

Account payable | 100 |

|

Outstanding payment/ Bank |

| 100 |

Vendor bill with full amount | Debit | Credit |

Stock interim received | 300 |

|

Account payable |

| 300 |

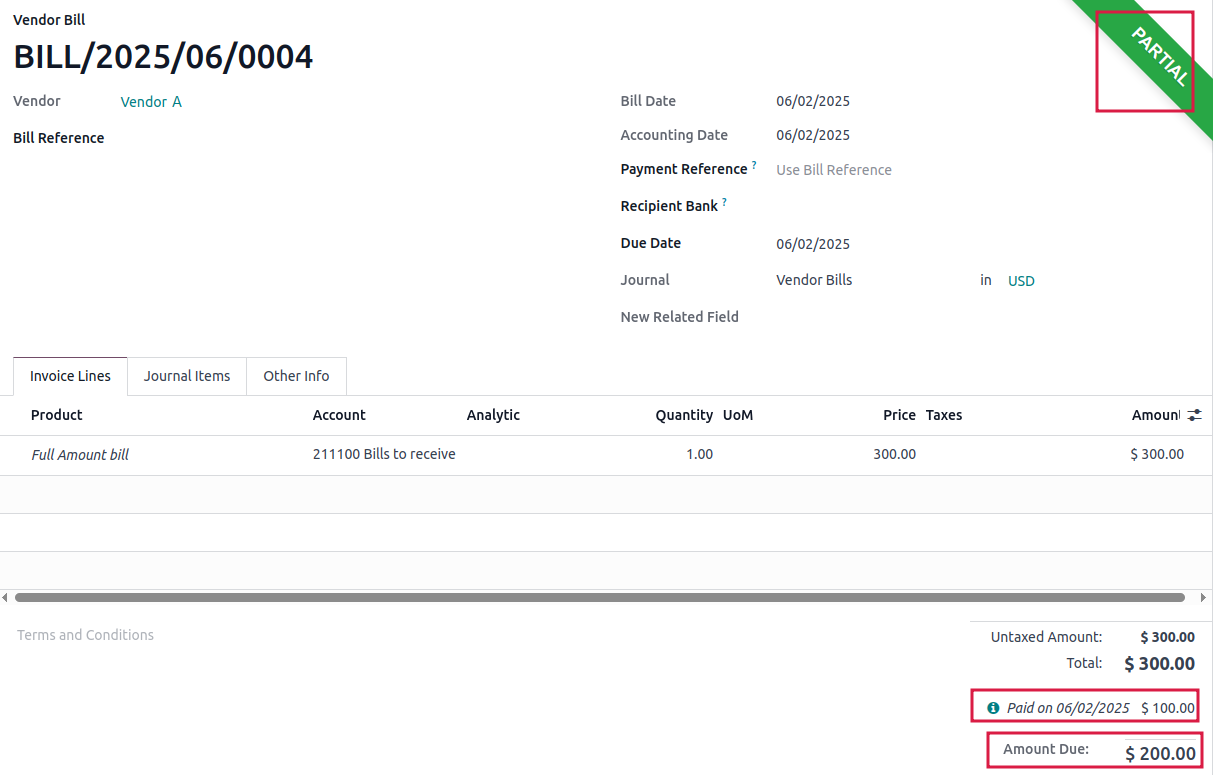

7. Now the vendor bill balance (amount due) is updated to $200.

The vendor bill status is updated to ‘partial’.

See also https://www.odoo.com/forum/help-1/odoo-18-0-how-do-i-link-a-downpayment-to-a-purchase-order-265600