Odoo v14 Asset Depreciation

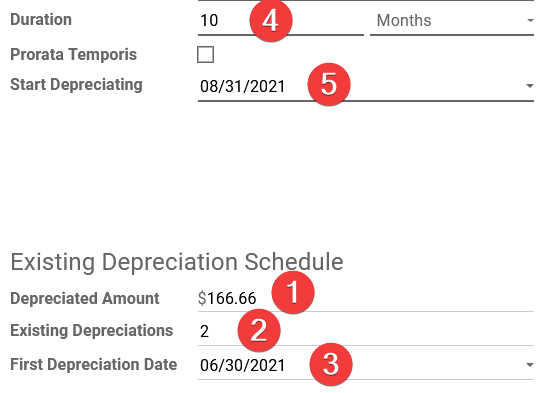

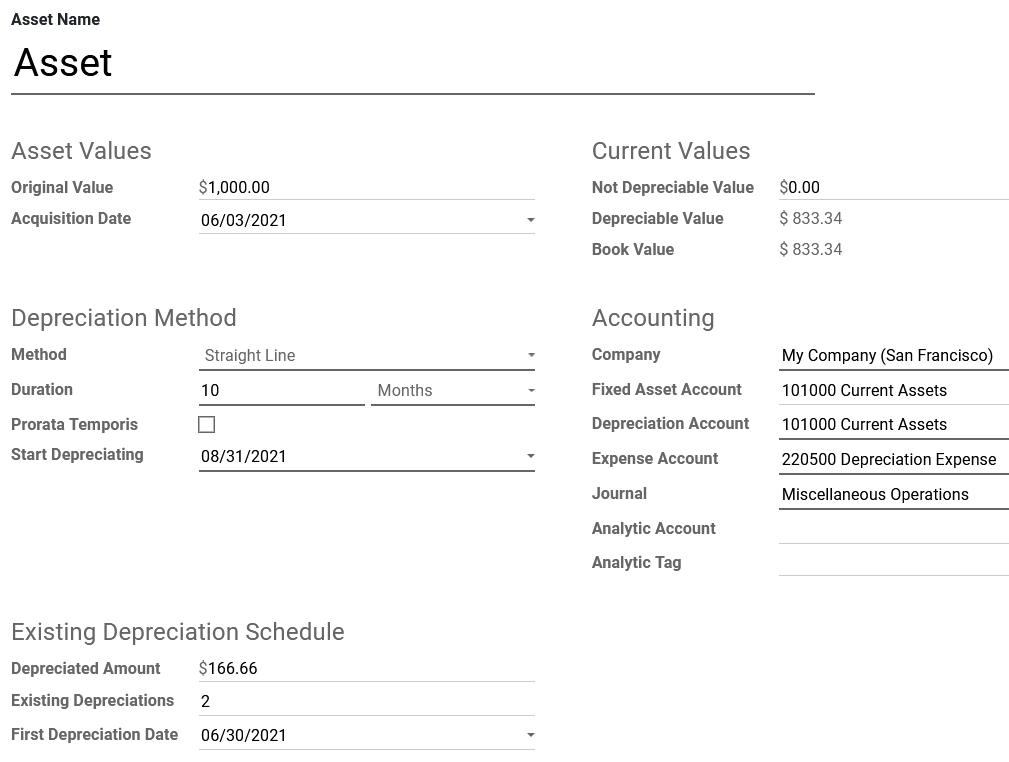

Migrating an asset from a non odoo business application with existing

depreciations.

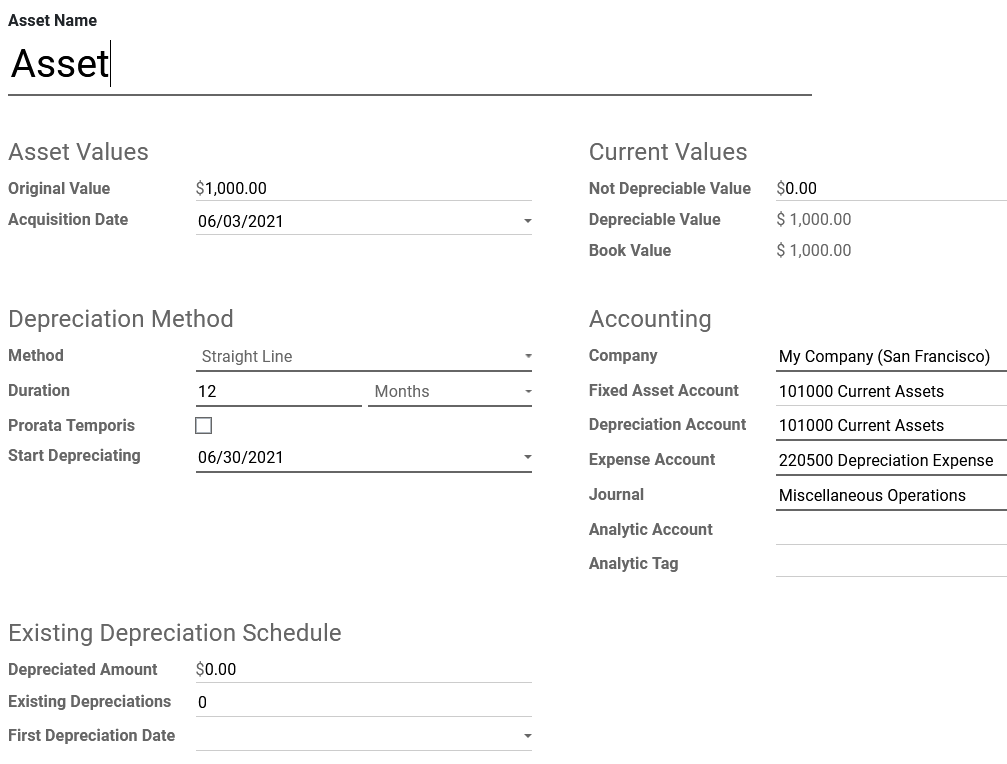

The asset Acquisition Date is 03/jun/2021

with a Prorata Date of 03/jun/2021

and

Start Depreciating 30/jun/2021.

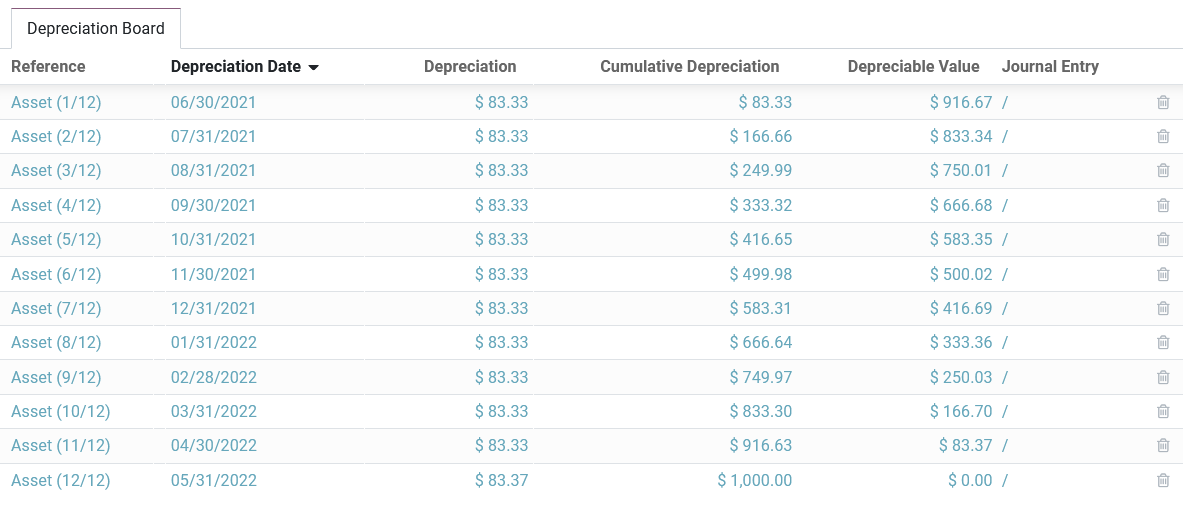

So far so good. Computing the Depreciation gives correct

value per month.

30/06/21 174.38 €

31/07/21 186.83 €

etc....Let’s say Client goes live with Odoo on 1st August thus we want to eliminate the first two months of depreciations that is

30/06/21 174.38 €

31/07/21 186.83 €

I have tried all combinations of ' Existing Depreciation Schedule' but have been unsuccessful to eliminate the first two months and once I confirm they are always posted.

any feedback is appreciated

(unfortunately I cannot attach screenshots, but I can email to anyone who can help)