| How to record the partial deductibility of taxes (Belgium) |

Odoo is the world's easiest all-in-one management software.

It includes hundreds of business apps:

- CRM

- e-Commerce

- Accounting

- Inventory

- PoS

- Project

- MRP

This question has been flagged

Hi Damien,

Can we not simply create a new tax which is part of 21% VAT group (if 21% VAT on full amount) for which we will allocate 30% of the total amount the 64 account non deductible VAT and 70% to the 411 account deductible VAT?

If not, why do we need to create the tax group?

Thx

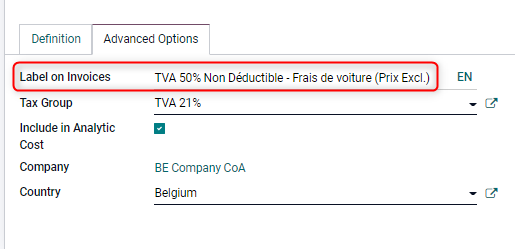

Yes Arnaud, you can create a new tax code (duplicate an existing one which is nearly the same - f.e 50% Non Déductible - Frais de voiture (Prix Excl.))

Then allocate the correct % deductible

Don't forget to update the label on invoice (and to double check the tax grid with the accountant ;-))

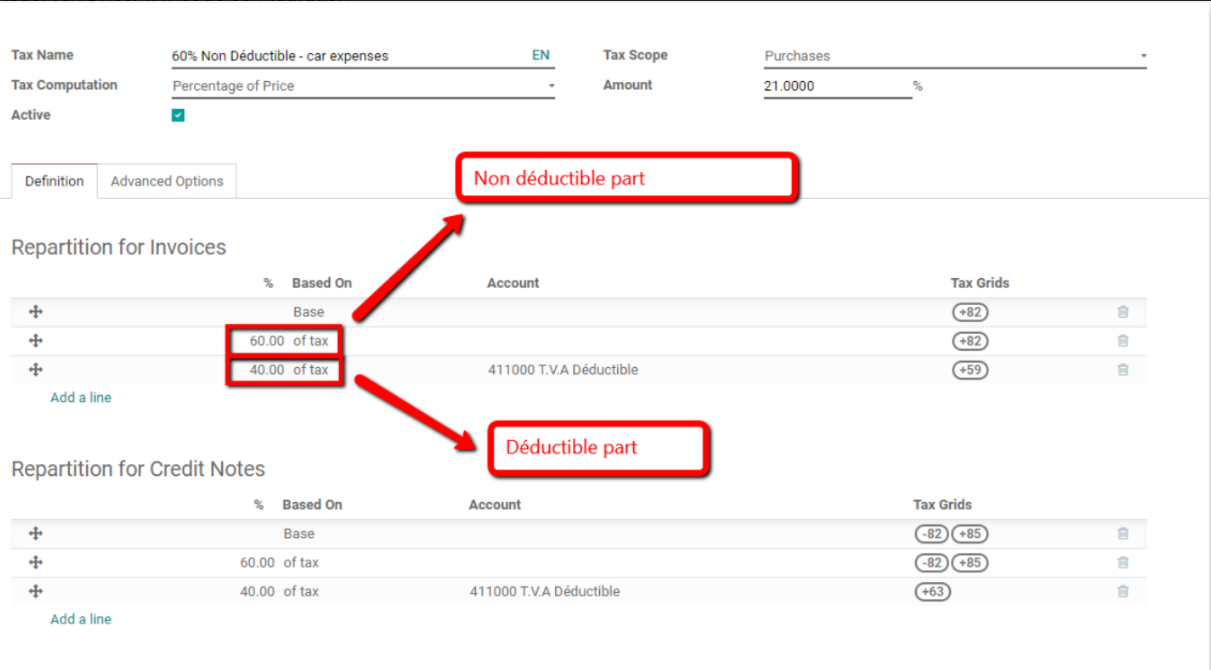

To help you with the partial deductibility of taxes in Belgium. In Belgium there are some taxes that are not fully deductible like the taxes on maintenance of car. There is the 21% VAT that is normally 100% deductible but in this case it is 30% deductible.

To help you with that you can create a group tax that will be composed of the 70% (of 21% = 14,7%) non deductible and the 30% (of 21% = 6.3%) deductible. Therefore you need to first create those taxes separately to add them into the group tax.

When you create those 2 taxes, be careful to get the correct tax account (example: account 411 TVA deductible and 640 taxes on cars and truck). Furthermore you need to specify a tag on the deductible tax. The grid should be, regarding this case, the 59, 63, 82, 85. Nonetheless, you should always ask the accountant of the customer to double check.

Enjoying the discussion? Don't just read, join in!

Create an account today to enjoy exclusive features and engage with our awesome community!

Sign up| Related Posts | Replies | Views | Activity | |

|---|---|---|---|---|

|

|

1

Jul 25

|

4493 | ||

|

How to deal with lock dates?

Solved

|

|

1

Aug 23

|

22796 | |

|

|

2

May 24

|

7237 | ||

|

|

1

Sep 24

|

5649 | ||

|

|

1

Aug 24

|

3210 |