What is the Single Administrative Document?

The Single Administrative Document (SAD) is the mandatory declaration form for all imports and exports that are subject to the customs authorities. This form is mandatory when international trade operations of goods are to be carried out.

This document contains the necessary information to declare to the Tax Agency all goods that are both imported and exported. This paper support is the basis for the declaration, it must include information about the goods and must always accompany the goods.

The origin of this declaration is to ensure that prices in international transactions are neither too high nor too low, it favors competitiveness in relation to prices. These prices are determined by Customs.

The Customs is the one who fixes a price for the goods, in case of buying a product for a lower price than the one marked by the Customs, the proportional part of taxes will be on the Customs price. That is to say, if we buy a product at a price of 1000€ and the customs marks the price at 1500€, at the time of invoicing, we will have to pay the DUA tax on the 1500€ set by the Customs agency.

What information must the Single Administrative Document include?

The document to be filed has different requirements and fields that must be completed, here is a list of what must be included:

- Type of declaration. Depending on whether it is a shipment to another Member State (CO), a country outside the European Union (EX) or to a member country of the European Free Trade Association (EU).

- Company name, address and VAT number of the shipper.

- Total number of items

- Number of packages included in the pallet.

- Receiver's company name, address and VAT number.

- Consignee for the goods

- Country of origin and its code

- Containers (if transported in containers)

- Delivery conditions

- Identity and nationality of the means of transport at the frontier

- Total amount and currency of the invoice

- Exchange rate

- Two-digit code indicating the nature of the transaction

- Description and numbering of packages

- Item number

- Commodity code (TARIC)

- Country of origin code

- Gross mass in kilograms

Who is obliged to file the Single Administrative Document?

At the time of filing the SAD, it must be done when the transactions are outside the European Union. Transactions between European Union countries are exempt, as they are considered imports or exports between member states and 0% intra-community tax is applied.

In the case of Spain, it must also be filed for goods coming from Ceuta and Melilla and imported to the Peninsula, the Balearic Islands or the Canary Islands.

How is it presented?

The SAD is filed through the Tax Agency's website, that is to say, it is a telematic filing. However, there is an exception for digital filing, which is when it is filed by an individual for a non-commercial shipment made by a particular person.

How does it work in Odoo?

In Odoo, we made a development to be able to carry out the processing of commercial transactions that are subject to the Single Administrative Document (SAD). This development includes the creation of some products to add to our supplier and carrier invoices. These Single Administrative Document (SAD) products are already subject to the corresponding VAT, i.e. the SAD 21% is assigned the VAT of 21%, the same happens with 10% and 4%.

When we have made a commercial transaction that is subject to these taxes, we generate two invoices. The first invoice is to our supplier, with the Odoo development it will not be necessary to add any SAD line, since the system recognizes that the price has been paid to the supplier.

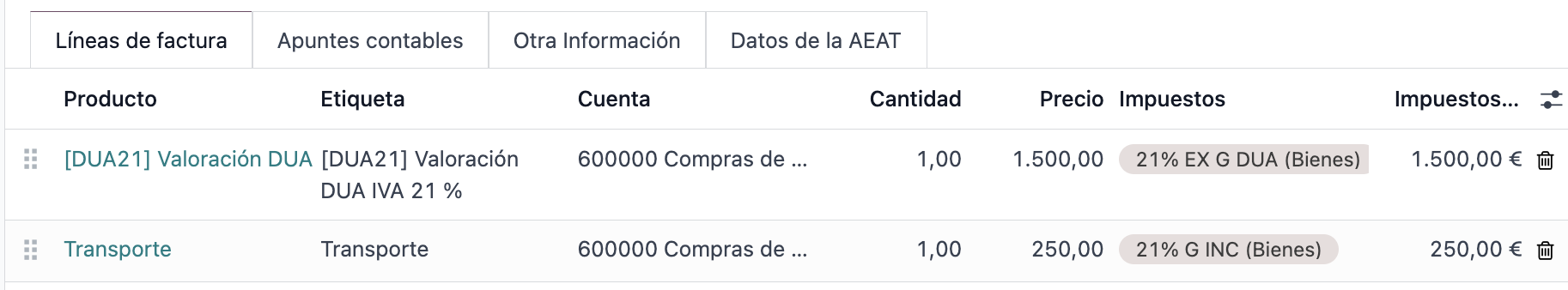

In the case of the invoice to our carrier, we add two lines. The first one will be the SAD product with the VAT percentage to which it is subject, which can be 21%, 10% and 4%. This percentage is on the value of the price marked by customs.

The second line will simply be the price of the carrier's services, which is subject to the corresponding VAT.

With these developments, simply by adding the corresponding SAD tax, the system will take care of the necessary adjustments for correct presentation.

Thanks to the development made by Odoo, all the invoices that include the Single Administrative Document lines will be directly related to the 303 and 390 tax forms , and will be directly included in the corresponding model box, box 32 in the 303 form and box 621 in the 390 form.

Single Administrative Document in Spain